Regular section-

Stats Window

STATS WINDOW

The Pacific Business Review International has taken an initiative to start a section which will provide a snapshot of major Global & Indian economic indicators and industry review alternatively.

A snapshot of the section in upcoming issues is hereunder:

Jan 2015 Economy at a Glance (Global & Indian)

Feb 2015 Hospitality Sector: Global Scenario

Mar 2015 Economy at a Glance (Global & Indian)

April 2015 Education industry: Global Scenario

May 2015 Economy at a Glance (Global & Indian)

AUTOMOBILE INDUSTRY IN INDIA

The automobile industry is one of the India’s most vibrant and growing industries and accounts for 22 per cent of the country's manufacturing gross domestic product (GDP). The auto sector is one of the biggest job creators, both directly and indirectly. It is estimated that every job created in an auto company leads to three to five indirect ancillary jobs.

India's domestic market and its growth potential have been a big attraction for many global automakers. Since the de-licensing of the sector in 1991 and the subsequent opening up of 100 percent FDI through automatic route, Indian automobile sector has come a long way. Today, almost every global auto major has set up facilities in the country. Austria based motorcycle manufacturer KTM, the established makers of Harley Davidson from the US and Mahindra & Mahindra have set up manufacturing bases in India.

As per the data published by Department of Industrial Policy and Promotion (DIPP), Ministry of Commerce, Government of India, the cumulative FDI inflows into the Indian automobile industry during April 2000 to October 2013 was noted to be US$ 9,079 million, which amounted to 4% of the total FDI inflows in terms of US $. The production of compact superbikes is also expected to take place in India. The country has a mass production base of 16 million two-wheelers and the several global as well as Indian bike makers are looking forward to use it as an advantage in order to roll out sports bikes in the 250 cc capacity.

The world standing for the Indian automobile sector, as per the Confederation of the Indian industry is as follows:

· Largest three-wheeler market

· Second largest two-wheeler market

· Tenth largest passenger car market

· Fourth largest tractor market

· Fifth largest commercial vehicle market

· Fifth largest bus and truck segment

However, the year 2013-2014 has seen a decline in the industry’s otherwise smooth-running growth. High inflation, soaring interest rates, low consumer sentiment and rising fuel prices along with economic slowdown are the major reason for the downturn of the industry. Except for the two-wheelers, all other segments in the industry have been weakening. Despite the comprehensive market being under extreme burden, the luxury car market has observed a robust double-digit hike during the year 2013-2014, as a result of rewarding new launches at compelling lower price points.

Market size

The automobiles sector is compartmentalized in four different sectors which are as follows:

· Two-wheelers which comprise of mopeds, scooters, motorcycles and electric two-wheelers

· Passenger Vehicles which include passenger cars, utility vehicles and multi-purpose vehicles

· Commercial Vehicles that are light and medium-heavy vehicles

· Three Wheelers that are passenger carriers and goods carriers.

The cumulative foreign direct investment (FDI) inflows into the Indian automobile industry during the period April 2000 – August 2014 was recorded at US$ 10,119.68 million, as per data by Department of Industrial Policy and Promotion (DIPP). Data from industry body Society of Indian Automobile Manufacturers (SIAM) showed that 137,873 passenger cars were sold in July 2014 compared to 131,257 units during the corresponding month of 2013. Among the auto makers, Maruti Suzuki, Hyundai Motor India and Honda Cars India emerged the top three gainers with sales growth of 15.45 per cent, 12 per cent and 11 per cent, respectively. The three-wheeler segment posted a 24 per cent growth to 51,461 units on the back of increased demands from the urban market. Total sales across different vehicle segments grew 12 per cent year on year (y-o-y) to 1,586,123 units. Scooter sales have jumped by 29 per cent in the ongoing fiscal, and now form 27 per cent of the total two-wheeler market from just 8 per cent a decade back. The ever-rising demand for scooters, which has far outstripped supply has prompted Honda to set up its first dedicated scooter plant in Ahmedabad. Tractor sales in the country is expected to grow at a compound annual growth rate (CAGR) of 8–9 per cent in the next five years making India a high-potential market for many international brands.

A total of 16.9 m two-wheelers were sold in FY14, a growth of a tepid 7% over the previous year. The slow growth was on account of the overall slowdown in the Indian economy and firm interest rates and fuel prices that dampened demand. Motorcycles accounted for 74% of the total two wheelers sold and grew by a mere 4% YoY. The scooters (geared & ungeared) segment was the star of the two wheeler industry logging in a growth rate of 22% YoY. In the domestic market, the 3-wheeler segment did badly as volumes were down 11% YoY, but the exports growth was strong at 17% YoY. It was a second consecutive challenging year for the medium and heavy commercial vehicles (M/HCVs) segment as volumes plunged by 25% during the fiscal given the sluggishness in industrial activity and low freight rates. LCVs were at the receiving end as well as volumes dropped by 17.6% YoY. As a result, volumes for the overall CV industry fell by 20% YoY. The HCV industry is highly cyclical and because the industrial and construction sectors slowed down, its effect was felt on HCVs as well. Both Tata Motors and Ashok Leyland faced heavy challenges during the year given that both of them corner a significant chunk of the CV pie.

Passenger vehicles (PV) also did badly as volumes declined by 6%. Slowdown in the economy, firm interest rates and fuel prices had an adverse impact on demand. This time the decline was seen across the segments of the PV space viz., passenger cars, utility vehicles (UVs) and vans. Maruti Suzuki, which is the market leader in the PV space, was not spared either and saw its volumes fall. As volumes took a beating, few of the companies did manage to report an improvement in operating margins largely on account of various cost rationalization measures undertaken.

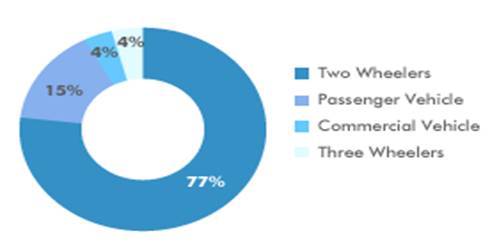

Market share of Indian automobile industry by volume

Two wheelers dominate production volumes in FY13, the segment accounted for 77 per cent of the total automotive production in India.

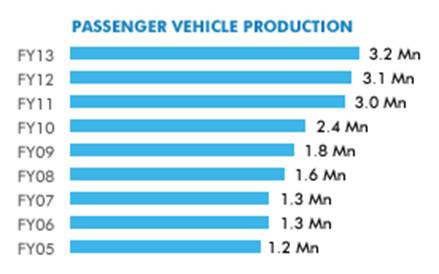

Passenger vehicle production in India

Passenger vehicles was the fastest growing segment, representing a CAGR of 12.9 per cent.

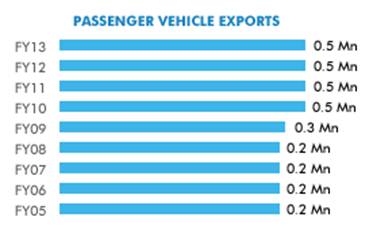

Passenger vehicle exports from India

Passenger vehicle exports from India stood at 0.5 million duting FY13.

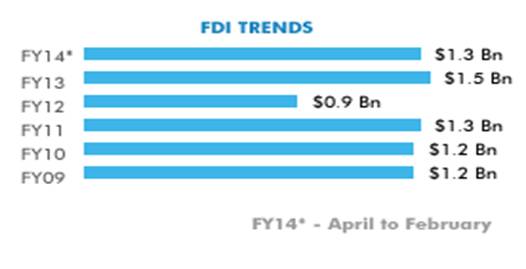

FDI in Indian automobile industry

FDI inflows in the Indian automotives sector aggregated to US$ 9.6 billion during April 2000-February 2014.

India: Growth of PV sales relative to the economic indicator

India: Passenger vehicle sales segment analysis

India: Automotive parts imports and exports

India: Passenger vehicle sales OEM analysis

Factors determining the growth of the industry

· Fuel economy and demand for greater fuel efficiency is a major factor that affects consumer purchase decision that will bring leading companies across two-wheeler and four-wheeler segment to focus on delivering performance-oriented products.

· Sturdy legal and banking infrastructure

· Increased affordability, heightened demand in the small car segment and the surging income of the Indian population

· India is the third largest investor base in the world

· The Government technology modernization fund is concentrating on establishing India as an auto-manufacturing hub.

· Availability of inexpensive skilled workers

· Industry is perusing to elevate sales by knocking on doors of women, youth, rural and luxury segments

· Market segmentation and product innovation

Passenger Vehicle sales

Total Passenger Vehicle dispatches were above 212,000 units. At this volume, deliveries to dealers were still lower than those in November 2012 (the best Nov till date), and even the deliveries of Nov 2011.

Mini, Micro and Compact Segment

In the biggest segments of the market, Maruti, Hyundai, Toyota, Tata and Volkswagen shored up the numbers while every other manufacturer saw a decline in dispatches.

Maruti-Suzuki dispatches in the segment were 6% up as the company made up for the Oct shortfall with November deliveries to dealers. Last month, MSIL had dispatched a significantly lower volume because of lower number of working days (19 as compared to the normal 25).

Super-Compact and Mid-Size segments

The Super-Compact segment is appearing quite thin with the Honda Amaze, Maruti-Suzuki D’Zire and Hyundai Xcent having moved to the Compact segment. Participation is rather thin with only the Toyota Etios, Mahindra Verito and Maruti-Suzuki DZire Tour (previous generation DZire) participating in the segment.

However, the Mid-size segment is a keenly fought battle. With the introduction of the Maruti-Suzuki Ciaz, it has become a three-sided battle between the Ciaz, Hyundai Verna and Honda City. Apart from these three, there are another seven models fighting n this segment.

The Ciaz is in the data honeymoon period and is helping Maruti-Suzuki notch up some healthy growth numbers. Dispatch volumes in Nov 2014 were 7221 units.

Commercial vehicles – HCVs Rule, MCVs & LCVs follow; SCVs Stabilise; Buses Crash

In the Commercial vehicles space, Heavy Commercial vehicles continued with their strong recovery. In the Heavy Trucks with rigid rear axles segment, dispatches were up by 71% overall. At 7127 units, the volume was still significantly lower than the Nov 2011 highs of 11100 units.

Ashok Leyland led the charge in the Heavy Trucks with Rigid Axles segment with a 165% improvement in volumes. The company’s Captain range appears to have received a good response and the company managed nearly 1700 units in dispatches in November. Both Tata Motors and Volvo-Eicher (VECV) too managed to nearly double their volumes from last year.

Recovery was even stronger in the Heavy Trucks with articulated rear axles (Artics / Tractor-Trailers) segment. Dispatch volumes were up by 223% at 1906 units.Again, the recovery was led by Ashok Leyland, which witnessed a 339% increase in dispatches at 628 units. Tata also had strong volumes and witnessed a 205% jump in volumes.The recovery in the HCV segment is an early indicator that the economy has started to recover. While the MCV segment has been lagging behind in the recovery and has reported negative growth in the last many months, November dispatches were significantly better.

Overall, the industry dispatched 5450 Medium Duty trucks in November 2014, a 11% jump from previous year. In the segment, growth was led by VECV, which reported a 20.4% jump in dispatches at 1364 units.Tata Motors had a good month too with a 9.6% jump in dispatches at 2850 units. Rival Ashok Leyland reported a 15.5% improvement in dispatches at 1074 units.In the Light Commercial Vehicles segment, dispatches were up 13.1%, An improvement across the three major commercial vehicle segments is a strong indicator of a recovering economy and of the market starting its journey to recovery.In the LCV segment, Force was the leader in terms of volume growth with dispatches of 1294 units.

Also having a good month was SML Isuzu, which reported 18% improvement in dispatches, though off a very small base.In contrast, market leader Tata Motors had a comparatively slow month with dispatches rising by only 10 units from last year. November 2014 volumes for Tata were 2136 units.

Also having a slow month was VECV with dispatches of 497 units, a 2% jump from Nov 2013. Mahindra dispatched 298 units, a 9.6% jump from previous year.

The Small commercial vehicles segment comprises of Goods Carriers below 3.5T GVW. It is essentially made of two types of vehicles – traditional pick-up trucks sold by Mahindra and Tata Motors and Indian market specific micro-trucks like the Tata Ace. The category has witnessed a severe crash over the last many months. Sales had been falling 40%-50% every month on a year-on-year comparison.

November 2014 was a slightly better month for SCVs as dispatches were down only 4% at just less than 27000 units. The stabilization was on account of Mahindra managing a 6.9% growth in its pick-up and small truck dispatches. At 12040 units, Mahindra also beat Tata Motors in November.

In comparison, Tata Motors dispatched 12006 units of its small trucks and pick-ups. This was a near 11.8% decline from previous year.Also having a bad month was Ashok Leyland, which dispatched 2272 units, a decline of 9.8% from previous year.

The Buses segment continued to stay depressed with deliveries falling 9% from previous year. Leading the fall was market leader Tata Motors with a 23.4% decline in deliveries at 737 units.Arch-rival Ashok Leyland was a story in contrast as it saw a 34.4% jump in deliveries at 657 units.The third prominent player, Eicher Motors, also saw a decline in dispatches at 134 units, a fall of 18.3% from previous November.

Two Wheelers – Motorcycles Falter; Scooters Zip

The two-wheelers story was a mixed lot as motorcycles stumbled yet again. However, sanity was maintained by Scooters, which continued to soar as if in a different market altogether.The Commuter Motorcycles (<125cc) segment declined by 6.3% over Nov 2013. At 692000 units in dispatches, this was the worst November in the last four years for the segment.The fall was led by Bajaj Auto which saw volumes almost halving in the segment. In November 2014, the company dispatched 59838 units, a 47.8% fall from Nov 2013 volumes of 114668 units. This was the worst November in the last six years for Bajaj Auto in the Commuter segment.

The segment is led by Royal Enfield (REML) , which witnessed a 53.5% jump in dispatches in the month. In November 2014, REML dispatched more than 27000 motorcycles, making it the best November yet for the brand.

Harley-Davidson dispatched 384 units, a 105% growth for the brand. This included 243 units of the Street 750. In comparison, REML shipped only 174 units of its flagship Continental GT in November.

Mopeds may be dead for most of us but the segment grew by 11.8% in November 2014. At 61630 units, this was sweet picking for TVS Motors, the only brand active in Mopeds now.

Scooter dispatches improved by 26.5% over November 2013. Dispatches in November 2014 were just short of 387,000 units. The growth was led by market leader HMSI which reported a 32.5% jump in dispatches at just short of 217,000 units.

Future Projections

The Indian automobile industry has a prominent future in India. Apart from meeting the advancing domestic demands, it is penetrating the international market too. Favored with various benefits such as globally competitive auto-ancillary industry; production of steel at lowest cost; inexpensive and high skill manpower; entrenched testing and R & D centre’s etc., the industry provide immense investment and employment opportunities.

The automobile industry in India is expected to be the world's third largest by 2016, with the country currently the world's second largest two-wheeler manufacturer. Two-wheeler sales is projected to rise from 15.9 million in FY13 to 34 million by FY20. The segment registered a growth of 7.31 per cent in FY14. Furthermore, passenger vehicle sales is expected to increase to 8.6 million in FY21 from 3.2 million in FY13.

Strong growth in demand due to rising income, growing middle class, and a young population is likely to propel India among the world's top five auto manufacturers by 2015. Automobile export volumes increased at a compound annual growth rate (CAGR) of 19.1 per cent during FY05-13, out of which two-wheelers accounted for the largest share in exports at 67 per cent in FY13.

The government aims to develop India as a global manufacturing as well as a research and development (R&D) hub. It has set up National Automotive Testing and R&D Infrastructure Project (NATRiP) centres as well as a National Automotive Board to act as facilitator between the government and the industry. Some other government initiatives, including Auto Policy 2002, Automotive Mission Plan 2006-2016 and funds allocated in the Union Budget 2014-15 could go a long way in ensuring the growth of this sector.

Alternative fuel has the potential to provide for the country's energy demand in the auto sector as the CNG distribution network in India is expected to rise to 250 cities in 2018. Also, the luxury car market could register high growth and is expected to reach 150,000 units by 2020.